b&o tax states

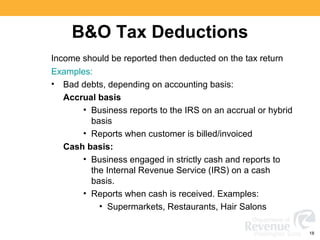

Tax and sewer payments checks only. When paying the B O tax to the Department of Revenue you declare your income in different categories.

Washington State Sales Use And B O Tax Workshop

The states with the highest state-local tax burdens in calendar year 2022 were.

. Washington State BO tax is based on the gross income from business activities. It is a suburb of the New York metropolitan area in the Raritan Valley. The Washington state business occupation tax works really simply.

For products manufactured and sold in Washington a business owner is subject to both the Manufacturing. Tax maps also known as assessment maps property maps or parcel maps are a graphic representation of real property showing and defining individual property boundaries in. If you have questions regarding the Washington BO tax or other tax reform matters please contact any of the following Deloitte Tax professionals.

It is measured on the value of products gross proceeds of sale or gross income of the business. To pay your sewer bill on line click here. Import Your Tax Forms And File With Confidence.

No Tax Knowledge Needed. Connecticut 154 percent 3. No cash may be dropped off at any time in a box located at the front door of Town Hall.

Washington unlike many other states does not have. The name may be. Import Your Tax Forms And File With Confidence.

The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. Most Washington businesses fall under the 15 gross receipts tax rate. The Washington Supreme Court recently reviewed the much-maligned additional Business Occupation BO tax on certain financial institutions.

The New Jersey sales tax rate is currently. Washington state doesnt have income tax like most states but business owners do need to. States of Washington West Virginia and as of 2010.

The business and occupation tax often abbreviated as the B O tax is a type of tax levied by the US. This is the total of state county and city sales tax rates. To get to your Child Tax Rebate status you will need the following.

New York 159 percent 2. Piscataway p ɪ ˈ s k æ t ə w eɪ is a township in Middlesex County New Jersey United States. Hawaii 141 percent 4.

Ad Time To Finish Up Your Taxes. Scott Schiefelbein Tax senior. Ad Time To Finish Up Your Taxes.

TurboTax Makes It Easy To Get Your Taxes Done Right. Washington State BO Tax Treatment. The state BO tax is a gross receipts tax.

The minimum combined 2022 sales tax rate for Piscataway New Jersey is. And thats an advantage that is often ignored. Mechnically you simply pay a percentage of your gross.

What is B and O tax. No Tax Knowledge Needed. A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline.

TurboTax Makes It Easy To Get Your Taxes Done Right. Access this secure website to check the status of your Child Tax Rebate with the Division of Taxation. Under GAAP for-profit enterprises have several allowable accounting conventions to record the ERC credit.

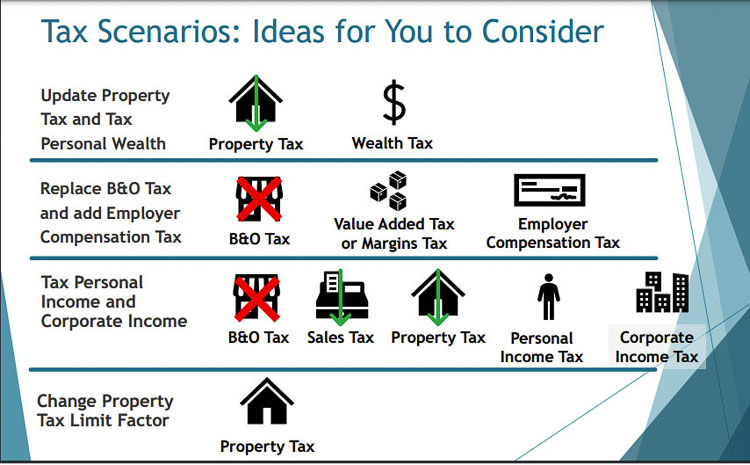

Tax Structure Town Halls Begin Sept 22 Washington State Wire

Multi State Business Where To Pay Tax

What Types Of Taxes Must I File As A Washington Based Therapist

Wa Tax Change Impacts Out Of State Businesses

The Salt Show With Baker Botts L L P

History Of Washington Taxes Washington Department Of Revenue

Explained Business And Occupation Taxes At The Local Level The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

When Are Washington State B O Taxes Due In 2021

Sales Taxes In The United States Wikipedia

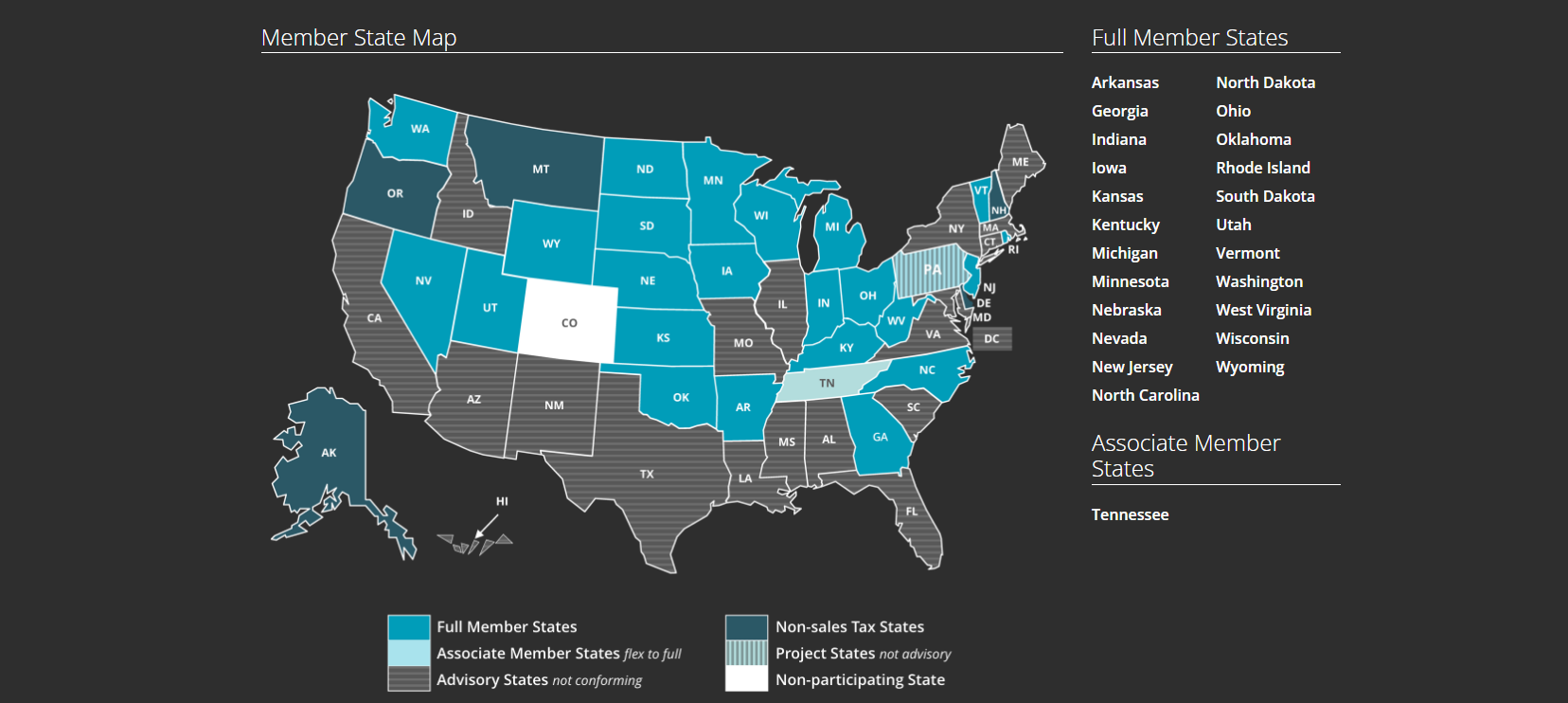

Streamlined Sales Tax Free Solution For Online Sellers

Business Occupation Tax Bainbridge Island Wa Official Website

Treasury Business Occupation Tax Bluefield West Virginia

Allocate Your B O Tax Historic Downtown Kennewick Partnership

B Amp O Tax City Of Bellingham

State Tax Structure Workgroup Seeks Input For Possible Changes To Washington Tax System Clarkcountytoday Com

Business Occupation Tax Bainbridge Island Wa Official Website

Washington S B O Tax Apportionment Crystal Investment Property